Established over 60 years ago, and headquartered in Reinach, Switzerland, Endress+Hauser now employs over 13 000 people. Many of these are employed in the manufacturing and sales subsidiaries, now operating in a total of 47 countries, but 5200 people are employed in the region around Basel in Switzerland. This area includes the major manufacturing plants at Maulberg in southwestern Germany, the centre for level and pressure instrumentation, and at Reinach in Switzerland, the flow measurement centre.

In May this year E+H invited 70 European based journalists to attend the presentation of their 2016 annual results, and to tour the Maulberg plant. As the major employer in the area, the company has several separate buildings on both sides of the main road – and the river. E+H has invested recently in expanding the production area, and has plans to release further space for expansion by building a multi-storey car park for the employees.

Entering the production area, the clean white walls and tidy work stations would delight even Chairman Nagamori of Nidec – as mentioned in last month’s column. But the overall impression was indeed of a calm and quiet operation. The area we were shown covered the radar level measurement production bays, which use Kanban stocks of sub-assemblies, all barcoded. Each product order is treated as a batch with a lot size of 1, so that the PC-based production screen calls up the necessary parts and then checks and records the scanned part number included in that build. Apparently the same production processes and plant layout are used in the other E+H plants making these products, in the USA, China and India.

Results for 2016

CEO Matthias Altendorf declared that Group sales were Euro 2,1 Bn for 2016, marginally below the previous year. In contrast to last year, currency fluctuations reduced the value of the consolidated sales: in local currencies the actual value of sales increased by 2,1%. The major income reduction came from purchases by the oil and gas industry, as well as chemicals and primary industries and metals. This adversely affected sales in the USA, UK and Norway. In Asia-Pacific the business also stagnated, but the Africa and Middle Eastern regions saw solid growth. While E+H performed well in Europe in general, a weak demand for German exports affected their figures in Germany, a major market.

The biggest growth area within the E+H businesses was in analytical instruments, such as the Raman spectroscopy products that provide on-line analysis of liquid and gas streams. Major users of the technique come from the life sciences sector, and the 2017 issue of the E+H corporate magazine ‘Changes’ features a special section looking at new applications in the sector. Biochemical production and fermentation reactions can be much more closely controlled with fast, online analysis of the input and effluent streams, both gaseous and liquid. E+H strength in this area is as a result of its strategic decision some years ago to invest in process analytical technology, particularly in optical spectroscopy, acquiring Kaiser Optical, Analytik Jena and SpectraSensors.

Other areas where strong sales growth had been seen included water and wastewater instrumentation, and the food and beverage industry. The power and energy industries also showed good performance, except in Germany.

Spending on expansion

Net income for 2016 was Euro 153m, around 7% down on the previous year. As a family-owned company, E+H has a strong loyalty to staff and the business future, and so employee levels have remained the same: plus Euro 149m was re-invested into buildings, plant and software/IT. This was below the planned Euro192m because of inevitable delays in project implementation.

Of this expenditure, nearly Euro 50m was used to upgrade the flow measurement production and office facilities at Reinach in Switzerland. Endress+Hauser Flowtec, established in 1977, started with three employees. Now it employs 1700, in six separate production sites around the world. The major production area at Reinach has been increased by over 50% in this latest expansion, which now covers 75 000 square metres: the facility was formally opened on the 40th anniversary of the founding of the company. Endress+Hauser Process Solutions, the competence centre for process automation and digital communication, is also to be housed in the new facility.

That ABB acquisition of B+R Automation

Swiss-based ABB is to acquire Austria-based B+R in a major deal. B+R sales were over $600m last year, in the $20Bn machine and factory automation market segment – an area in which ABB has never been a successful player. ABB will integrate the B+R products in PLC, Industrial PCs, HMI, I/O modules and servo motion as well as its software and solution suite, expanding its industrial automation offering. It believes that this, combined with the ABB Robotics business, should accelerate them into a significant presence in factory automation, despite the current dominance of Siemens, Schneider and Rockwell Automation.

B+R considers that it provides customers in virtually every industry with complete solutions for machine and factory automation, motion control, HMI and integrated safety technology. B+R will become part of the ABB Industrial Automation division and form a new global business unit – Machine and Factory Automation – headed by the current B+R managing director, Hans Wimmer. Both companies consider B+R management and employees key drivers of future growth.

The integration will be growth-focused and live by the ‘best-of-both-worlds’ principle, with ABB adding its own PLC and servo drive activities to the offering of the new business unit in a phased approach. ABB underlines its clear commitment to continuing the B+R growth story (CAGR of 11% over the last 20 years) by articulating a mid-term sales ambition to exceed $1bn.

Will the plan work out?

To answer whether the B+R acquisition will give ABB a boost in industrial automation, the right expert is Alex West of IHS Markit, a market analysis company in the UK, where he is a principal analyst, specialising in factory automation. He advises as follows:

This acquisition gives ABB, one of the leading vendors in process automation, a step-up in terms of a discrete automation portfolio, which was an obvious gap in its offering. It also brings access to discrete automation sectors and an established business with over 4000 machine builders. By acquiring B+R, ABB has expanded its knowledge pool. It now has more expertise in discrete automation, which has strengthened its capability of providing products and IoT solutions to OEMs in sectors like packaging machinery. There is certainly opportunity to expand its IoT solution business as the uptake of IoT technology has so far been faster in discrete sectors, particularly those that are consumer related.

ABB CEO Ulrich Speisshofer considers that the combined global customer base will create huge opportunities for the Fourth Industrial Revolution, with an “installed base of more than 70 million connected devices, 70 000 control systems and now more than 3 million automated machines and 27 000 factory installations around the world”. Does this make the combined company a concern for other leading suppliers of industrial automation components?

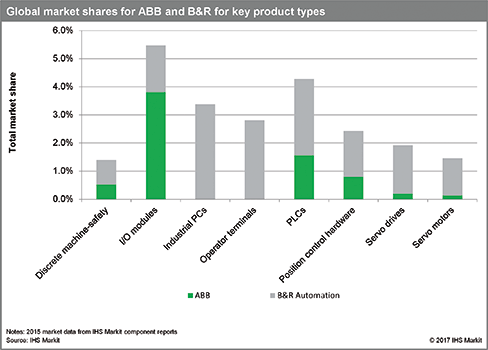

Globally there is little change to the competitive environment in terms of supplier rankings. According to the IHS Markit Industrial Automation Equipment Tracker, at a global level ABB shows little advancement in the market share ranking. It will gain share for products such as industrial PCs, PLCs, servo drives and servo motors. The latter two product rankings show the greatest changes for the combined company. ABB was estimated to be ranked number 32 of servo drive suppliers and now moves to a top 15 position. For servo motors, ABB was ranked number 35 globally in 2015; the combined business is now estimated at number 14. Significant changes, but not enough to pose a threat to the leading suppliers to these markets.

This acquisition brings the combined company into more direct competition with Schneider Electric as it now has comparable global market shares for I/O modules, industrial PCs, position control hardware, servo drives, and servo motors. The greatest market share increase is estimated for the industrial PC market, with a market share increase of 3% to place the combined company as the seventh largest supplier in revenue terms. The market share increase is estimated at around 3% for the operator terminal and PLC markets. This puts ABB as the tenth largest supplier of operator terminals and sixth largest for PLCs at a global level.

EMEA market impact

ABB will also gain the ability to scale the machine automation business in Europe, where B+R Automation generates around 65% of global sales. In the EMEA region, the ABB market share is estimated to increase by around 3% for I/O modules when using 2015 base figures. This moves ABB to second place of the leading suppliers to the EMEA market, above Schneider Electric. In EMEA the combined company is estimated to have gained market share of over 4% for operator terminals and PLCs, making it one of the top five leading suppliers for these products.

Smart manufacturing

An area that may be worth watching is the ABB Ability Platform and how it will develop over the next few years. With trends to IIoT and smart manufacturing it is becoming increasingly important for industrial automation companies to develop and support software portfolios. CEO Spiesshofer commented that this may be a driver of further ABB acquisitions.

The ABB acquisition of B+R Automation will fill a gap in the existing portfolio and will give them access to an established and loyal machine builder customer base. This will certainly be a concern for other leading suppliers to these product markets and sectors.

[IHS Markit is a Nasdaq quoted consultancy, headquartered in London, delivering next-generation information, analytics and solutions to customers inbusiness, finance and government.]

Nick Denbow spent 30 years as a UK-based process instrumentation marketing manager, and then changed sides – becoming a freelance editor and starting Processingtalk.com. Avoiding retirement, he published the INSIDER automation newsletter for five years, and then acted as their European correspondent. He is now a freelance Automation and Control reporter and newsletter publisher, with a blog on www.nickdenbow.com

© Technews Publishing (Pty) Ltd | All Rights Reserved