Companies often buy applications they do not need, or do not need as much as other applications. They also often neglect to buy applications they need in order to satisfy other priorities.

I have been approached many times by users who complain that they get applications they do not need and do not get the applications they do. I also get asked by information management (IM) people why business does not want to spend money implementing value-adding software, even when they can show an exceptional ROI. This problem has faced the software engineering fraternity from the first manufacturing IM solutions. To understand why this situation exists and maybe define a way to resolve it, we need to understand the conflicting ways business and IM view plant systems.

Business (or plant management) want to improve performance. They have certain business objectives they are trying to achieve. Often, IM will motivate a solution to a problem that is not considered important enough to warrant attention (even if it makes ROI sense) as it is not part of the plant objectives for improvement. Even if the solution can resolve a specific plant problem that is one of the focus areas, the software still needs to compete with physical equipment for funds and the equipment normally wins. IM thus needs to ensure that any solution they try to motivate actually falls within a key focus area of the plant.

Looking at the same situation from an IM perspective, they may have been approached by plant personnel to resolve a problem, but it may be that the problem is more of a ‘nuisance’ than a spending priority, even if they can prove ROI. IM are also the people in the plant familiar with the solutions and technology available to assist the plant. As such, they often spot improvement opportunities where plant personnel are happy to continue with the status quo. In these cases, even if the project gets approved, implementation is going to be difficult and requires a lot of change management.

It should be clear from the above that there are three major aspects to address and balance in order for IM to make a strong enough case for implementing a software solution:

* Business needs priority.

* Plant application gap.

* Buy-in from role-players.

Business needs

Identifying business needs in terms of plant priorities is normally one of those areas that is most neglected by IM when they want to assist business. One of the problems often experienced is that these priorities change frequently in reaction to plant and business conditions. One thing that remains more constant however, is the key performance indicators (KPIs) of the business. To use these as a base to prioritise application needs is thus a reasonably safe bet for IM. A process can then be developed where KPIs are rated or prioritised against, for instance, ISA 95 activities for production, inventory, quality or maintenance. This rating needs to determine the impact each of the activities will have on a KPI if it is not done effectively. Once this is complete, it will be possible to rank each ISA 95 activity in terms of importance to the business. It is preferable that this rating is done by the business executives, as this activity will start the buy-in process.

Plant application gap

The next step would be to identify the maturity of applications supporting each of the ISA 95 activities. In order to do this, it is necessary to develop some sort of maturity index against which the applications can be evaluated. Here it is required that one looks at instrumentation, automation and applications currently in place as well as those that will take the company to a ‘Best in Class’ situation. A rule of thumb to assist in developing such an index would be to assign at the lowest level the basic minimum of instrumentation, automation or application that would be implemented if a similar new plant were being built under budgetary constraints. At the highest level, ‘Best in Class’ instrumentation, automation and applications would be assigned. Between these, applications can be added in a progression of steps from ‘Basic Minimum’ to ‘Best in Class’. This activity is best done jointly with IM.

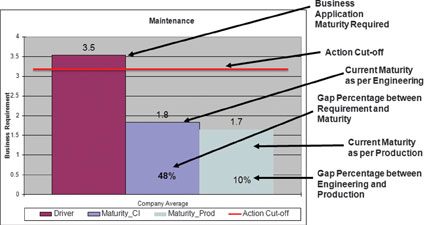

Once the maturity index has been completed, the current application maturity can be rated against the index, providing a maturity score for each of the ISA 95 activities. This rating should preferably be done by the users of the applications within production and business. It is interesting to note that users and IM often differ in their evaluation of application maturity. For this reason, it may be valuable to have IM also rate the maturity of applications. A big gap in the rating between IM and users may indicate a lack of training in the available functions of current applications.

Once the application maturity has been rated for each ISA 95 activity, it can be compared to the importance of that activity in the business as rated by the executives. A big gap between business need and application maturity will indicate areas of potential improvement. In addition, the maturity index will also provide the steps required to close this gap. Typically, there are gaps in most ISA 95 activities and as such it would be difficult to prioritise activities to be addressed first. For this reason it is advisable to determine a business need cut-off level at which no action will be taken. It is also interesting to note those areas where the application maturity exceeds the business need, as these would be areas where money was potentially wasted.

Buy-in

The last step would be to identify specific initiatives to close the gap between business need and application maturity. As stated previously, the maturity index would be a good place to start identifying initiatives of the appropriate priority.

This process also assures buy-in from all levels and disciplines, as everyone is involved in the evaluation in some form. People are also more amenable to accept when their specific requirements are not addressed immediately and more willing to give their buy-in if they were part of, and understand, the process used to determine priorities. This is true for both management and users.

In addition, the process also indicates to management the activities that would contribute towards the achievement of the business objectives and are therefore worth the time and investment.

For more information contact Gerhard Greeff, Bytes Systems Integration, +27 (0)11 205 7000, [email protected], www.bytes.co.za

© Technews Publishing (Pty) Ltd | All Rights Reserved