Top automation companies

Working with ARC this year, CONTROL magazine has cleaned up the criteria for its list of 'Top-50 Automation Vendors'. Editor Walt Boyes of CONTROL, and Larry O’Brien of ARC - well done!

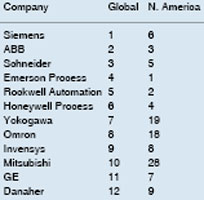

If I might, let me list just the top 12 companies, based on sales, showing how they change from global to N. American rankings. For some well-known companies on the list, I will provide my own commentary that might interest you.

Total world-wide sales for the top-50 companies equates to $65B, which represents the approximate market size for industrial automation; add just a couple of percentage points for the combined sales of companies not listed.

The top six global companies shuffle their ranks in N. America. But the Japanese (seven, eight and 10 world-wide) drop way behind in N. America, to 19, 18 and 28 respectively.

With almost $2B revenue, Invensys jumps from nine globally to eight in N. America, while GE jumps from 11 to seven.

National Instruments keeps growing and is now 22 globally at over $700M revenue, jumping to 13 with 70% in N. America.

MTL (soon to be part of Cooper/Crouse-Hinds) is 40 globally at $175M, jumping to 32 in N. America. Intrinsic-safety rival Pepperl+Fuchs is 29 worldwide at $446M and 30 in N. America, with $85M.

Matrikon is on the list at 48 with $77M global revenue, over 60% of that in N. America.

The old connector/terminal block rivals, Phoenix and Weidmuller used to be neck-and-neck as they shifted focus to electronics. Now Phoenix has jumped ahead to 15 globally, at $1,25B, while Weidmuller has dropped to 24, at $639M.

OPTO-22, recognised for its distinctive products, did not make the list, beyond ‘honourable mention’. This means that the company is still languishing at less than $60M worldwide, and $22M in N. America. Pity.

Still independent software supplier Iconics was 46 on the N. American list, with revenues of almost $30M, but did not make the global list. Wonderware, of course, is part of Invensys.

Beijing HollySys was 50 on the global list, the only China-based vendor included. Advantech has grown to $200M worldwide, 38 on both the global and N. American lists.

Mini-conglomerate Spectris is now 14 globally at $1,4B, dropping to 16 in N. America with $340M. Ametek, another acquirer, is 17 worldwide at over $1B, jumping to 11 with over 50% of revenues in N. America. Roper Industries is following the same path with small acquisitions, and is 28 on the global list at over $0,5B, 80% of that in N. America earns a ranking of 14.

There is a lot more interesting stuff on this list, the only one of its kind in the automation industry. Take some time to study this and you will get the pulse of the automation business

Technologies and markets

Here are my pointers and prognostications regarding the top automation technology and market trends that will gain traction in the coming year.

* Industrial wireless – industrial wireless networks will quickly become integrated with standard plant and office networks. Beyond just wire replacement, there are lots of applications which will contribute to substantial market growth.

* Embedded intelligence and diagnostics – embedded operating information and selfdiagnostics will minimise the need for scarce and expensive factory-service.

* Machine-to-machine (M2M) communications – M2M will unleash a wave of productivity previously unseen – improved asset-management, and enhanced service initiatives.

* Automation system security – most of today's automation and control systems use the same hardware, operating systems, and communications as broadly deployed networks. Security has become an urgent issue.

* Consumer tech in industrial automation – Internet access via cellular phones, handheld PDAs and the like, is inevitably rubbing off in industrial environments. Specifically-industrial software applications are coming.

Success will come to the companies that understand how to combine and coordinate new technology, new thinking and effective solutions for customers in global markets.

Jim Pinto is an industry analyst and commentator, writer, technology futurist and angel investor. His popular e-mail newsletter, JimPinto.com eNews, is widely read (with direct circulation of about 7000 and web-readership of two to three times that number). His areas of interest are technology futures, marketing and business strategies for a fast-changing environment, and industrial automation with a slant towards technology trends.

© Technews Publishing (Pty) Ltd | All Rights Reserved