Shareholders have one major criterion on their minds - ROI (return on investment). Is this investment a balloon or a brick? Among other things, investment performance is highly dependent on sales. Sales can only happen with products that are known to exist. While many products are already known to exist, obviously the customer can only know about a particular brand from two sources: marketing or referral. (Yellow pages are most often the last resort.) Sales are more likely when the product is well known, and when there are less known competing manufacturers.

Referral has momentum, and it usually builds up slowly and slows down slowly - although it can drop suddenly if the manufacturer's product quality drops, (bad news travels fast). Normally, once customers are having success with a brand, they will likely continue to use it, and will probably tell other customers about it. Referrals are driven by the cost-effectiveness and quality of the product - and the level of service. If the customer is feeling the pinch they may look for alternatives in an attempt to increase their efficiency; if they find something else, your referrals will dwindle.

Marketing lets potential customers know that the manufacturer's product exists. It can be an opportunity for manufacturers/suppliers to make sure that potential customers know of any advantages that their brands may have over the competition. For a significant portion of potential clients, marketing is the only way they can get any impression about those manufacturers/suppliers at all.

Marketing and recessions

What happens in recessions is that customers look for ways of cutting expenses. They may look at finding ways to do without the widgets - or they may look at other brands in a bid to keep their business running by using more efficient widgets. Generally, sales drop. To many manufacturers, less sales means that they must cut expenses - and the first place they look is often marketing. As the recession worsens, the more borderline manufacturers/suppliers go belly-up, and their remaining customers have to look for another supplier. They will more likely choose one that looks strong.

While reading his favourite trade publication, this ex-customer of Belly-up Widgets Inc notices that many of the familiar adverts are either missing, or are now smaller. But wait - there is Brand X's widget advert - as usual... hmm. He remembers their inviting looking stand at the last trade show... Calling them up he hears a cheerful, optimistic greeting, and gets prompt, quality service. He tells his circle of friends in the industry. The word spreads, and Brand X continues with its adverts. More adverts drop out as the recession takes hold. There stands Brand X, looking like an oasis amidst a landscape of drought.

Other customers hear of how well the manufacturer/supplier of Brand X widgets is doing, its (recession related) drop in turnover begins to abate. Brand X is able to keep its (per unit) profit margins lower than most, as its turnover is now higher than most. Investors are watching how business is looking in that sector, they are looking for trends, and they see that Brand X has turnover figures that are beginning to stabilise while others are dropping faster. Maybe they sell their shares and invest in the manufacturer of Brand X.

While this is obviously not what happens in every instance, it certainly is a noticeable phenomenon during recessions: those who maintain their marketing campaign consistently, fare better than those who cut back, or abandon their marketing campaigns.

Yes, but which came first?

Of course the big question is which is the cause and which is the effect? Do companies lose because they cut their marketing budget, or do companies cut their marketing budget because they are losing? Perhaps it works much like an electromagnetic wave, where there is an electrical component and a magnetic component - without both there can be no electromagnetic wave.

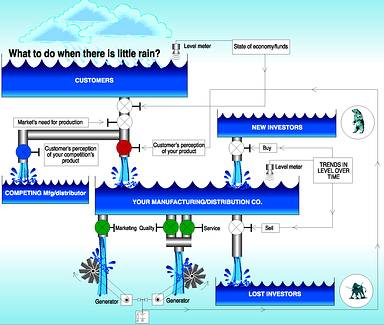

For a manufacturer/supplier to survive in a free market system, there have to be three things: the need for such a product, the ability to offer that product, and the market's knowledge of that product. Without a marketing drive (of some description) there is only word of mouth... if sales are dropping, so will the referrals, which will affect sales - what is there (besides marketing) that could hope to arrest the trend? The momentum experienced from a high market perception is lost as that perception in the market dwindles. Customers switch brands to save pennies - some quit their line of business. Sales start falling, marketing gets cut back even more, market perceptions drop further... the green valves get closed, the red valve closes, the bulls stray to greener pastures, the bears crank open the 'sell' valve... and all the water drains from the tub.

In conclusion, it may appear that reducing flow through the marketing valve only makes sense when not doing so would mean robbing from quality and service. The dynamics that operate in a recession will favour the distributors/manufacturers that maintain their presence, quality and service - when others are seen to be wilting. The winners after a recession are typically those who maintained a marketing drive, where many others cut back. History would suggest that when making marketing budget decisions, companies should endeavour to adopt a 'brave face' policy during a recession.

To find out more about how Technews may work with you as your media partner, give us a call, or e-mail us.

Sales: Jane Fortmann, 031 764 0593, [email protected]

Editorial: John Gibbs, 031 764 0593, [email protected]

© Technews Publishing (Pty) Ltd | All Rights Reserved