Our economy, going by GDP, has a structure, certain parts of which are more energy-intensive than others, particularly electricity-wise, and some of which have much more flexibility in the way they can adjust their production processes.

This is an important consideration in getting to grips with the absolute losses due to electricity interruption (GDP output irretrievably lost).

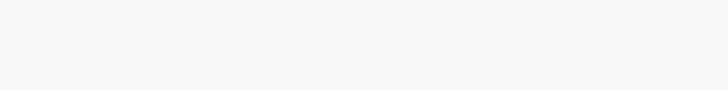

Our GDP output structure is currently as follows:

As can be seen, primary extractive activities nowadays contribute only 9% to total GDP value-added. Even the mostly goods-producing industrial activities contribute barely over 20%. Thus, primary and secondary activities contribute only one-third of GDP. In contrast service activities contribute two-thirds GDP.

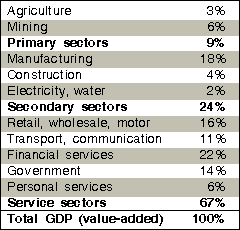

When it comes to which sectors of the economy use electricity most and which least, Eskom's 2007 Annual Report breaks down electricity sales as follows:

As can be seen, industrial and mining are major electricity users.

It is understood that households directly (Eskom) and indirectly (redistributors) consume some 21% of total electricity sold. By far the larger component thereof is for pure household consumption, although a small share supports economic activity conducted from home (and therefore part of GDP output).

This leaves some 27% of electricity sold to commerce, business and government users, most of them of a service nature. There probably is light goods manufacturing mixed among these users, especially the very large number of small and medium-sized business enterprises in the cities.

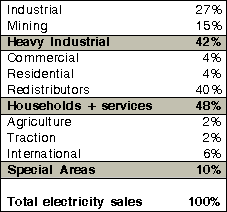

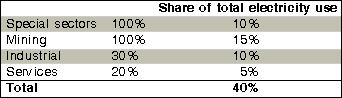

GDP sector weight and share of non-household electricity usage can be presented as follows:

So when we leave out special sectors (cross-border, agriculture and Transnet) as strategic interests, we are left with 53:30 ratio for heavy primary electricity users (mining, industrial) and 34:67 ratio for mostly services and small business users of electricity.

As to the flexibility of value-added GDP activities, each of these sectors presumably differs greatly in their ability to delay production (use production facility at another time when under-utilised and electricity is available) or otherwise improve productivity by doing things differently.

This in contrast to output irretrievably lost due to electricity interruption (continuous steel mill).

By now, we should be able to make a few very unpleasant observations, even when exceptions to the rule can easily be found:

* Non-flexible production that cannot delay or otherwise substitute output without electricity, leading to direct irretrievable loss of output, includes most of mining and a very large part of industrial, except that the latter may have a large component of capacity not as yet on three shifts (ie not as yet 24/7).

* In services, the opposite condition probably prevails. A very large share of activity can adjust to electricity interruption, by changing working hours or doing things differently, without ultimately losing the value-added activity.

This leads to the following very rough guess-estimates regarding irretrievable output loss due to planned (rather than unplanned) electricity interruption:

What conclusions does all this lead to when we want to maximise continuous economic activity at times of severe electricity interruption, assuming we can target users with some precision (which is seemingly not the case)?

* Leave mining mostly alone, unless we are prepared to incur permanent output loss.

* Those industries using continuous processes should equally be excluded, provided they run 24/7. When extra work shifts could be run, intelligent targeting would allow such businesses to reconfigure their production runs, assuming labour and unions agreed, and possibly allowing for higher overtime compensation (but then this is a national emergency, according to government spokesmen).

As to what economic activity could be saddled with electricity interruption, yet with a good chance of economic activity continuing, if sometimes at great personal inconvenience and increased cost (severe loss of personal welfare not reflected in GDP activity):

* Household electricity consumption (except it would penalise those working from home, causing GDP loss).

* Most service activities, but not necessarily all small business enterprises, many of whom have critical dependency on electricity and no other affordable source than Eskom.

* Those industrial users with spare work shift capacity.

That suggests, roughly, that the following electricity sectors should be left alone when labour shedding is contemplated:

On this simple reasoning, at least 40% of electricity off-take should be 100% exempt when load-shedding becomes inevitable. If one then still needed to obtain a 20% saving in electricity, it should be obtained from the remaining 60% usage, in other words a one-third targeted reduction rather than a 20% blanket.

If a 20% permanent reduction in the call on total Eskom power needs to be achieved immediately, voluntary savings need to be obtained, rationing needs to be imposed and new supplies of non-Eskom electricity be encouraged (diesel generators, solar panels, waste heat and other forms of new supply of which so far 5000 MW of suggestions have been made).

To the extent that load shedding needs to be imposed, the above analysis shows where this should concentrate as opposed to what should ideally be exempted.

Alternatively, the above analysis shows up the penalty of GDP output lost, whether through targeting critical users (for instance mines accept 15% output loss by not working one full day a week), by imposing blanket blackouts or simply not managing the process well.

In the case of mining, up to 70% of normal electricity use may still in many cases be required to keep mines in operational condition (controlling underground water levels).

Simply put, load shedding focused on households, most services activity and half of industry may incur minimal GDP losses, if scheduled intelligently, requiring most businesses and government departments (and in particular their workforces) to fully adjust to the imposed changes.

Longer-term, Eskom needs to build more power stations, and users should try to achieve Eskom independence as soon as can be afforded, through generators, solar panels and other schemes, and by changing working practices.

For more information visit www.fnb.co.za/economics

© Technews Publishing (Pty) Ltd | All Rights Reserved